Nearly seven years ago, CFO asked finance chiefs an accounts receivable question: Would you allow a customer to pay in bitcoin? Now, the issue is one of cash management: Would you allow your treasury team to invest excess corporate cash in Bitcoin?

Tesla and MicroStrategy have. In early February, Elon Musk’s carmaking company changed its short-term investment policy to allow it to invest an aggregate $1.5 billion in balance sheet cash in Bitcoin. MicroStrategy, headed by crypto uber-evangelist Michael Saylor, did the same, storing more than $1 billion of the business analytics’ firm’s reserve dollars in the cryptocurrency.

What’s going on? Bitcoin was supposed to be a secure and anonymous medium of exchange via blockchain technology that didn’t need the involvement of fractional-reserve banks. As a peer-to-peer decentralized currency, some early disciples claimed it would lead to democratization and disintermediation of the global financial system. That hasn’t happened.

Digital currencies’ extreme price volatility prevented all except those with the strongest stomachs from allowing customers to buy things with it. And now, skyrocketing digital currency prices have turned them into speculative assets, more like commodities or securities or gold.

Retail and institutional investors have a sustained and growing interest in the likes of Bitcoin. The launch of CME Bitcoin futures in 2017 and options in 2020 has helped spark that institutional interest.

But there’s a major stumbling block to widespread adoption — when it comes to regulation, cryptocurrencies are still the Wild West. When digital coins are used as cash, for example, it’s often by bad actors. Some estimates suggest that one-quarter of all Bitcoin users are involved in illegal activity, to the tune of $76 billion per year, or 46% of all bitcoin transactions. Many experts believe, however, that the days of that kind of activity are numbered.

“Investors are increasingly handling the assets as they would any other asset in the portfolio — sometimes profit-taking, sometimes reinvesting, using the volatility to their advantage, and using these alternatives to help with all-important diversification,” says Nigel Green, CEO of financial consultancy DeVere Group.

With these strategies becoming mainstream, he says “cryptocurrencies must come into the regulatory tent and be held to the same standards as the rest of the financial system.”

T. Paul Rowland, a former CFO of Brane, a Canadian-based fintech focused on blockchain technology, agrees: “Technically speaking, crypto can be used to completely circumvent the rules. I would argue if you want to play in this game, be legitimate, and get institutional investors involved, bring crypto from the dark into the light and play by the rules.”

Regulators Struggle

U.S. lawmakers have been regulating digital currencies for a while with limited success.

Most of the efforts have been patchwork and tentative. As attorney Josias N. Dewey, a partner at Holland & Knight, sums up in his book, The Blockchain: A Guide for Legal and Business Professionals: “Policymakers and other officials have often struggled to apply laws crafted decades ago, in many cases, built on assumptions now being challenged by the technology.”

Numerous U.S. states are taking very different approaches to the technology, while the federal government has relied on its agencies to float regulatory proposals.

But jurisdictions aren’t well defined: The Securities and Exchange Commission claims federal power over virtual currencies insofar as they have the properties of a security. The U.S. Commodity Futures Trading Commission has oversight of derivatives transactions (cash, spot, and futures) related to a virtual currency to the extent it is considered a commodity. The Financial Crimes Enforcement Network (FinCEN) regulates money services transmitters and has issued interpretative guidance for virtual currency exchanges. And the U.S. Treasury and federal banking regulators have oversight powers.

Progress in dragging cryptocurrencies out of the shadows has been slow. But in December 2020 and January 2021, U.S. regulators proposed two new rules for cryptocurrency transactions that could have wide-ranging effects.

The first rule is intended to stifle the activities of bad actors by requiring virtual currency exchanges to remove their customers’ cloak of anonymity. The second rule allows banks to form their own blockchains, exchange currency tokens for fiat cash, and conduct other kinds of cryptocurrency transactions and payment activities.

These measures are a significant step forward, according to former CFO Rowland. “I think it’s something that the industry has been calling for,” he says. “Regulators are now beginning to come to grips with the fact that cryptocurrencies aren’t going away.”

Know Your Customer

In the first proposed regulation, FinCEN would require banks and money service businesses to identify and keep records of certain kinds of transactions that occur on cryptocurrency exchanges. The federal regulator also wants exchanges to abide by bank reporting rules that require a filing when customers make cash withdrawals or deposits worth more than $10,000.

The reaction to the proposal has been mixed. Backers point to the potential to expose bad actors and increase comfort for institutional investors, but ardent crypto-evangelists and industry players see it as stifling the essence of cryptocurrency.

The Global Digital Asset & Cryptocurrency Association (GDCA) representing more than 110 organizations (including, for example, spot and derivative exchanges and custodians) argues that the decentralized and privacy-centric infrastructure inherent in cryptocurrencies means reporting rules may have the unintended effect of pushing participants to the gray markets, outside of effective U.S. jurisdiction. That would hinder law enforcement, says the GDCA.

Square’s CEO Jack Dorsey echoed that point. He said that the proposal creates “perverse incentives for cryptocurrency customers to avoid regulated entities for cryptocurrency transactions” and pushes them into foreign jurisdictions. He adds, “FinCEN will actually have less visibility into the universe of cryptocurrency transactions than it has today.”

For now, the battle is at a standstill. On January 22, President Biden froze all rulemaking carried over from the Trump administration, pending reviews. That included FinCEN’s proposal.

Enter Banks

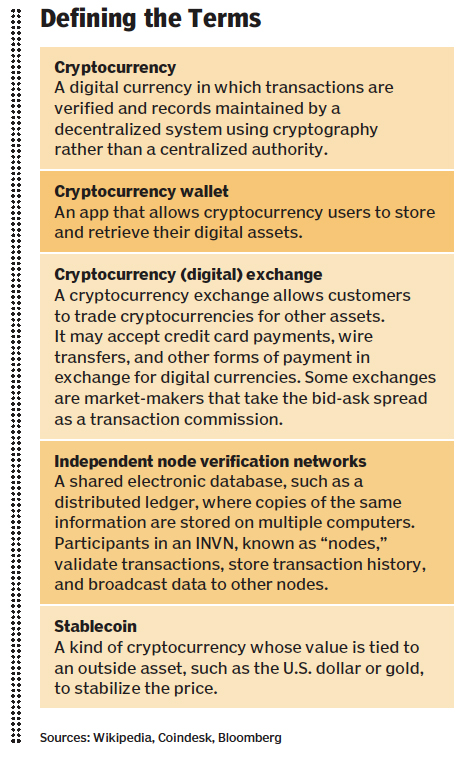

The second rule, from the Office of the Comptroller of the Currency, gives the go-ahead for federally chartered banks and thrifts to use independent node verification networks (INVNs, also known as blockchain) and stablecoins to participate in digital currency transactions. (See box, “Defining the Terms.”) While some banks were already making inroads in that space, the ruling signals that transacting in digital currency is a reasonable extension of traditional banking, experts say.

OCC-regulated banks will be able to issue digital coins and exchange existing coins for fiat currency. Those capabilities come with custody responsibilities, requiring the validation, storage, and recording of payment transactions on the blockchain.

In the OCC’s public statements, it’s apparent that what it likes about blockchain is its resiliency (due to its decentralized nature) and the fact that it limits tampering with the transaction database. Of course, the OCC also warned banks that they need to protect against money laundering activities by adapting Bank Secrecy Act compliance programs to address cryptocurrency transactions.

What does all this mean for banks and their customers? As long as the new head of the OCC backs the rule, “it’s a new dawn for digital currencies”, says Rowland. “It’s so important for the crypto custody infrastructure side of the digital asset business to be able to provide investor and customer confidence.”

In addition, “banks want to be in this space; they’re getting pinged by their existing customers who are holding crypto-assets or want to hold crypto-assets.”

Against this backdrop, some financial market players are plunging in. For example, in early 2021 the OCC granted conditional approval for the conversion of state-chartered Anchorage Trust Company to Anchorage Digital Bank, National Association, a crypto-based bank. Card giant Visa, a series B-round investor in Anchorage, is working with it to allow customers to buy and sell digital currencies. It also is experimenting with open application programming interfaces to allow other banks to access Anchorage’s digital infrastructure.

The OCC also gave a green light to Seattle-based Protego Trust to use a federal charter to provide custody services for clients to hold digital currencies. Users of Protego’s platforms will also be able to engage in person-to-person lending and trading.

The proposed regulations may not suit every cryptocurrency firms’ agenda, but digital currencies are slowly being brought under the umbrella of financial regulators. Will more corporate treasury departments join the rush for digital gold as a result? Having been burned in the past by new investment instruments, most may take a pass for now.

But clearer rulemaking frameworks will certainly attract more institutional money. The other thing they will do is help cryptocurrencies live up to what they were originally viewed as — as a medium of exchange for goods and services around the world.

Ramona Dzinkowski is a journalist and president of RND Research Group.

Source: https://www.cfo.com/regulation/2021/02/will-cryptocurrencies-play-by-the-rules/